SCHEME DOCUMENT

Customized exclusively for the registered customers of

IBIBO GROUP PRIVATE LIMITED

ABOUT CARE HEALTH INSURANCE LIMITED

CARE Health Insurance Limited (formally known as Religare Health Insurance Company Limited) is focused on the

delivery of health insurance services. Our promoter's expertise in the spectrum of financial services, healthcare

delivery and preventive health solutions, coupled with a robust distribution model, offers us a unique edge to deliver

and excel in a business environment that hinges on serviceability and scale. Powered by the best-in-class product

design and a customer centric approach, CARE Health Insurance Limited is committed to delivering on its innate

values of being a responsible, trustworthy and innovative health insurer. CARE Health Insurance Limited is promoted

by strong entities- Religare Enterprise & Union Bank of India.

POLICY CONDITIONS & BENEFITS

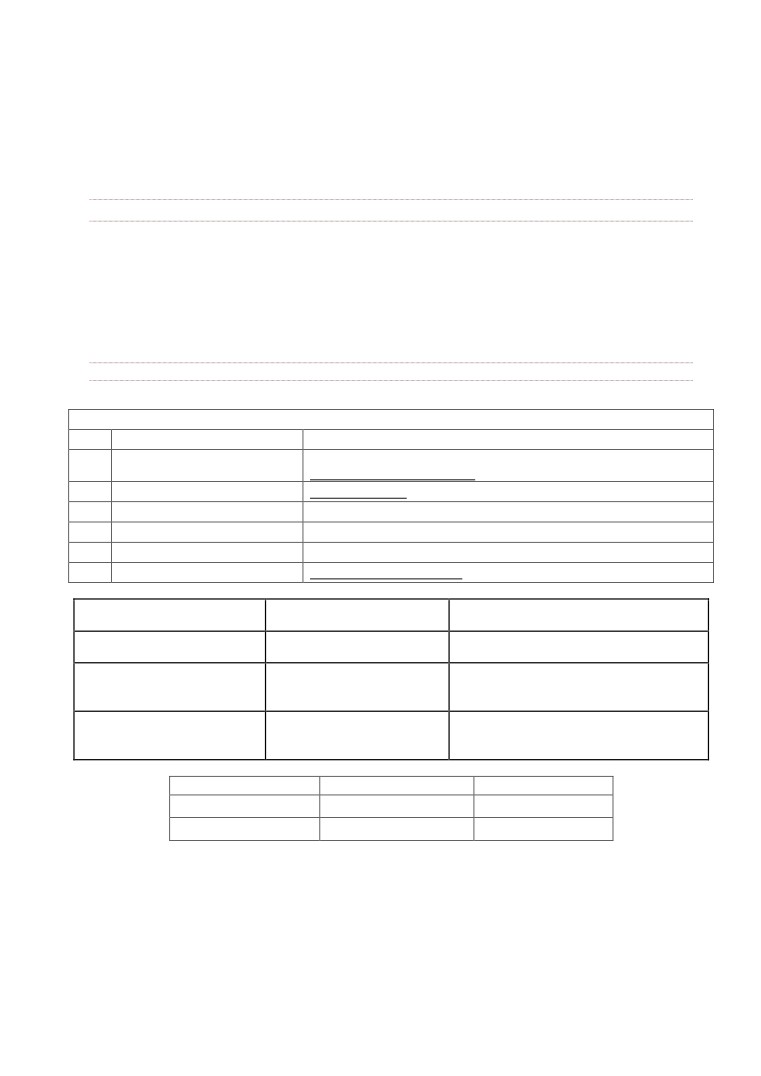

Member Details

S.No.

Basic Details

Particulars

Individual Plan : Self , Spouse ,Dependent Children ( Below 25 years) and

1

Family Structure

Parents /In-laws up to 65 years

2

Age Band

91 days - 65 years

3

Health Card

E-card

4

Sum Insured Type

$ 50,000 and $ 100,000

5

Maximum trip duration

31 days

6

Purpose of trip

Official/Personal Leisure trip

Benefits

Option 1

Option 2

Emergency medical expenses

$ 50,000

$ 100,000

$ 1,750 (includes $ 125 per

Daily Cash Cover

$ 2,450 (includes $ 175 per day for 14 days)

day for 14 days)

Repatriation of Mortal

$ 1,000

$ 1,500

Remains

Age group

Geographical Scope

Trip Type

91 days to 65 Years

Worldwide

Single Trip

91 days to 65 Years

Worldwide

Single Trip

Option - 1 (Premium rates are inclusive of GST)

DURATION of the stay

Asia (Rs.)

Worldwide (Rs.)

(days)

00-03

830

1256

04 to 06

962

1464

07 to 10

1156

1774

11 to 14

1398

2160

15-18

1606

2494

19-22

1770

2758

23-27

1922

3002

28-31

2044

3200

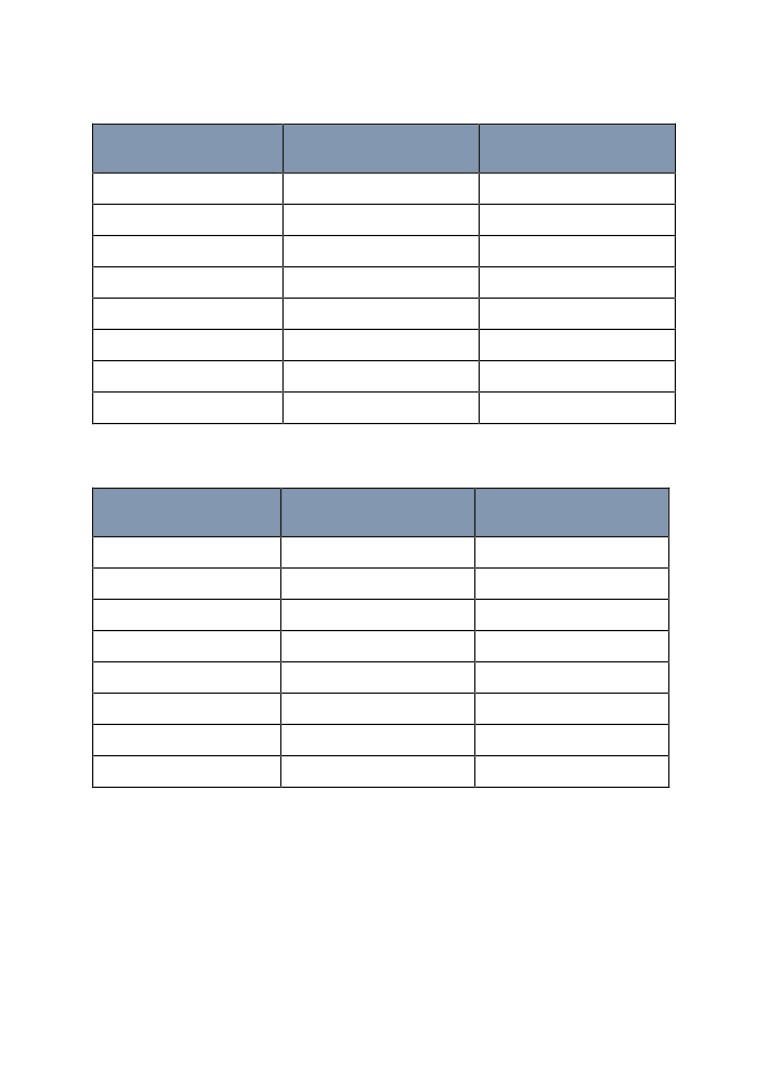

Option - 2 (Premium rates are inclusive of GST)

DURATION of the stay

Asia (Rs.)

Worldwide (Rs.)

(days)

00-03

948

1434

04 to 06

1098

1672

07 to 10

1322

2026

11 to 14

1598

2470

15-18

1836

2850

19-22

2024

3152

23-27

2196

3432

28-31

2336

3658

POLICY FEATURES & EXCLUSIONS

Medical Cover

We shall indemnify the Medical Expenses reasonably incurred by the Insured for medical treatment

undertaken on account of any Illness contracted or Injury.

a. Under this Benefit, Insured has the option to choose either :

(1) IN-PATIENT CARE

If an Insured Person is diagnosed with an Illness or suffers an Injury that requires the Insured

Person’s

Hospitalization, then We will indemnify the Medical Expenses incurred on

Hospitalization;

OR

(2) IN-PATIENT CARE FOR INJURY

If an Insured Person suffers an Injury that requires the Insured Person’s Hospitalization, then We

will indemnify the Medical Expenses incurred on Hospitalization.

b. DAY CARE TREATMENT

If an Insured Person has to undergo Day Care Treatment, We will indemnify the Medical Expenses

incurred on that Day Care Treatment.

*Hospitalization resulting due to COVID19 will be covered. Please note that Mandatory quarantine or

isolation imposed by any country without COVID -19 detection are excluded from scope of cover.

Exclusions:

Any Claim in respect of any Insured Person for, arising out of or directly or indirectly due to any of the

following shall not be admissible under these Benefits unless expressly stated to the contrary elsewhere

in the Policy:

(i)

Medical treatment taken outside the Country of Residence/City of Residence if that is the sole

reason or one of the reasons for the journey.

(ii)

Any treatment or Medical Expense incurred for any illness/injury which was pre-existing at the time

of commencement of Policy

(iii)

Any treatment, which could reasonably be delayed until the Insured Person's return to the Country

of Residence/City of Residence.

(iv)

Rest or recuperation at a spa or health resort, sanatorium, convalescence home or similar

institution.

(v)

Routine physical tests and / or examination of any kind not consistent with or incidental to the

diagnosis and treatment of any Illness or Injury either in a Hospital or as an outpatient and any type

of vaccination or inoculation if it does not apply to post-bite treatment.

(vi)

Physiotherapy expenses or any services provided by chiropractitioner.

(vii)

Expenses related to any kind of Non-medical charges, service charge, surcharge, night charges levied

by the hospital under whatever head.

Daily Cash Cover

We will pay for each continuous and completed day of Hospitalization for a maximum specific duration as

chosen by the Policyholder if the Illness or Injury suffered by the Insured Person requires Hospitalization.

However, in case ‘Zero days’ deductible applicability, we will pay 50% of daily Allowance limit in case of

Day Care Treatment.

*Quarantine resulting due to COVID19 recommended by Medical Practitioner will be covered. Please note

that Mandatory quarantine or isolation imposed by any country without COVID -19 detection are excluded

from scope of cover.

Repatriation of Mortal Remains

If the Insured Person dies solely and directly due to an Accident, We will indemnify for the costs of

repatriation of the mortal remains of the Insured Person back to the Country of Residence / City of

Residence or for a local burial or cremation at the place where death has occurred.

Claims Management

a. Notification of Claim

In case of claim, You / Insured Person should immediately notify Us or the Assistance Service Provider

about the Claim by calling at the toll free number as specified in the Policy or in writing and provide

the following details :

(i)

Policy Number;

(ii)

Policyholder’s Name;

(iii)

Name of the Insured Person in respect of whom the Claim is being made;

(iv)

Nature of Illness or Injury or contingency for which Claim is being made and the Benefit under

which the Claim is being made;

(v)

Date of admission to Hospital or date of loss, as applicable;

(vi)

Name and address of the attending Medical Practitioner and Hospital (if applicable);

(vii)

Any other information, documentation or details requested by Us or the Assistance Service

Provider;

Any event that may give rise to a Claim has not to be notified to the Company or the Assistance Service

Provider, within 48 hours of Hospitalization or before discharge (whichever is earlier).

b. Documents to be submitted

You or Insured Person (or Nominee or legal heir if the Insured Person is deceased) shall (at his

expense) provide the documents specified below and any additional information or documents as

specified in the benefit under which the claim is being made to Us or the Assistance Service Provider

immediately and in any event within 30 days of the occurrence of the Injury / Illness or loss or

treatment.

(i)

Duly completed and signed Claim form, in original;

(ii)

Passport copy with entry/exit stamp;

(iii)

Any other document as required by Us or Assistance Service Provider

(iv)

Additional documents as specified for each benefit

Note : All invoices and bills should be in Insured Person’s name or as per the documents mentioned

in the respective Benefits. Depending on the nature of the Claim, treatment undertaken or illness,

there would be a possibility of seeking more information / document from the Claimant concerned

without prejudice to his interest and the same shall be requested by any means of recognized

communication channels.

However, claims filed even beyond the timelines mentioned above should be considered if there are

valid reasons for any delay.

Duties of the Claimant

It is agreed and understood that as a Condition Precedent for a claim to be considered under the Policy:

(i)

All reasonable steps and measures must be taken to avoid or minimize the quantum of any

Claim that may be made under this Policy.

(ii)

The Insured Person shall follow the directions, advice or guidance provided by a Medical

Practitioner and We shall not be obliged to make payment that is brought about or contributed

to by the Insured Person failing to follow such directions, advice or guidance.

(iii)

Intimation of the Claim, notification of the Claim and submission or provision of all information

and documentation shall be made promptly and in any event in accordance with the procedures

and within the timeframes specified in ‘Claims Management’ section here above and the

specific procedures and timeframes specified under the respective Benefit or Optional Benefit

or Optional Extension under which the Claim is being made.

(iv)

The Insured Person will, at our request and at his / her own cost and expense, submit himself /

herself for a medical examination by Our/Assistance Service Provider’s nominated Medical

Practitioner as often as We considers reasonable and necessary.

(v)

Our/Assistance Service Provider’s Medical Practitioner and representatives shall be given access

and co-operation to inspect the Insured Person’s medical and Hospitalization records and to

investigate the facts and examine the Insured Person.

(vi)

We shall be provided with complete documentation and information which We have requested

to establish its liability for the Claim, its circumstances and its quantum.

(vii)

Report any information / document which helps the insurance system to eliminate bad practices

in the market.